Financial Planning

Class-10-Mathematics-1-Chapter-4-Maharashtra Board

Notes

|

Topics to be learn :

|

Introduction :

- GST stands for Goods and Service Tax.

- Taxes that existed before were Excise Duty, Custom Duty, VAT, Entertainment tax, Central sales tax, Service tax, Octroi etc. all these taxes are subsumed (incorporated) under GST.

- GST is in effect from 1st July 2017.

- Rates of GST are different for different products such as 0%, 5%, 12%, 18% and 28%.

- These rates are fixed and prescribed by the government.

- GST rates are subject to change. Electricity, petrol, diesel etc. are not under purview of GST.

Some terms of GST :

CGST and SGST are the two components of GST.

- CGST : Central Goods and Service Tax. This is to be paid to the central government.

- SGST : State Goods and Service Tax. This is to be paid to the state government.

GSTIN : Goods and Service Tax Identification Number. GSTIN is mandatory for the dealer whose annual turnover in the previous financial year exceeded ₹20 lakh. GSTIN has 15 alphanumeric. This includes 10 digit PAN of the dealer.

Example :

Goods and Service Tax invoices :

- HSN : Full form of HSN is Harmonized System of Nomenclature. All Goods are classified by giving numerical code called HSN code. It is to be quoted in the tax invoice.

- SAC : These are called SAC or Service Accounting Code. Services are also classified and special code numbers are given.

Tax Invoice :

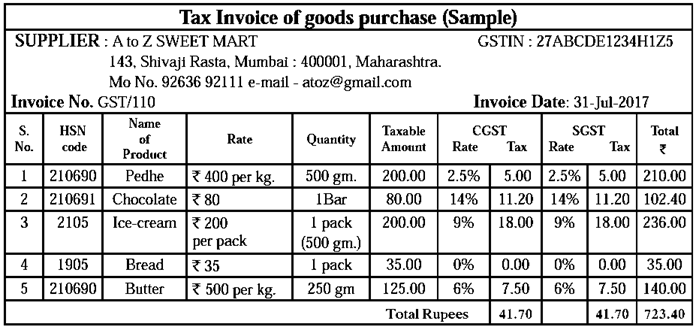

Study the Sample of Tax Invoice of goods purchase : You will get an idea regarding computation of CGST and SGST

Explanation for above bill :

- CGST at the rate of 2.5% is ₹ 00 and SGST at the rate of 2.5 % is ₹ 5.00. It means that the rate of GST on Pedhe is (2.5 + 2.5)% = 5%, and hence the total GST is ₹ 10.

- The rate of GST on chocolate is 28 %, and hence the total GST is ₹ 22.40.

- The rate of GST on ice cream is 18 %, and hence the total cost of ice cream is ₹00 .

- On butter, CGST rate is 6 % and SGST rate is also 6 %. So GST rate on butter is 12 %.

- Rate of GST on bread is 0 %. The rate of CGST and SGST is same for each product. i.e. there is no GST on bread.

- The rate of CGST and SGST are the same. The rate of GST = The rate of CGST + The rate of SGST.

Examples of Goods and services items list and GST :

| Sr.

No. |

Types | Rate of GST | Goods and services items list |

| I | Zero rated |

0% |

Goods - Essential Commodities like food grains, fruits, vegetables, milk, salt, earthen pots etc.

Services - Charitable trust activities, transport of water, use of roads and bridges, public library, agriculture related services, Education and Health care services etc. |

| II | Low rated |

5% |

Goods- Commonly used items- LPG cylinder, Tea, cof- fee, oil, Honey, Frozen vegetables, spices, sweets etc. Services - Railway transport services, bus transport services, taxi services, Air transport (economy class), Hotels providing food and beverages etc. |

| III | Stand- ard rated

(I slab) |

12% |

Goods- Consumer goods : Butter, Ghee, Dry fruits, Jam, Jelly, Sauces, Pickles. Mobile phone etc.

Services - Printing job work, Guest house, Services related to construction business. |

| IV | Stand- ard rated

(II slab) |

18%

|

Goods - Marble, Granite, Perfumes, Metal items, Computer, Printer, Monitor, CCTV etc.

Services - Courier services, Outdoor catering, Circus, Drama, Cinema, Exhibitions, Currency exchange, Broker Services in share trading etc. |

| V | Highly rated |

28% |

Goods - Luxury items, Motor Cycles and spare parts, Luxury cars, Pan-masala, Vacuum cleaner, Dish washer, AC, Washing machine, Fridge, Tobacco products, Aerated water etc.

Services - Five star Hotel accommodation Amusement parks, Water parks, Theme parks, Casino, Race course, IPL games, Air transport (business class) etc. |

GST in trading chain :

Trading Chain (within state) :

Manufacturer → Wholesaler or Distributor → Retailer → Consumer

Let’s learn through an example how GST is charged and paid to the government at every stage of trading.

Illustration :

- Suppose manufacturer of a watch sold one watch for ₹ (including profit) to the wholesaler.

- Wholesaler sold that watch for ₹ 300 to the retailer.

- Retailer sold it to the customer for ₹

- Rate of GST charged at every stage is 12%.

Then how each trader pays GST and takes his input tax credit (ITC) at every stage of transaction is shown in the following flow chart. Observe and study it.

Explanation :

- Here, three financial transactions took place till the watch from manufacturer reaches the customer.

- How the taxes are charged, collected and paid to the central government and state government at each stage is shown below.

- The statement of taxes paid is given in the table thereafter.

(i) Manufacturer :

| Tax invoice of Manufacturer (B2B) | GST paid to Government by Manufacturer |

| Selling Price of watch = ₹ 200

CGST 6% = ₹ 12 SGST 6% = ₹ 12 Total = 224 |

Total GST calculated = ₹ 24

Less : Input tax credit (ITC) = ₹ 0 Net GST paid to Government = ₹ 24 |

(ii) Wholesaler :

| Tax invoice of Wholesaler (B2B) | GST paid to Government by Wholesaler |

| Selling Price of watch = ₹ 300

CGST 6% = ₹ 18 SGST 6% = ₹ 18 Total = 336 |

Total GST calculated = ₹ 36

Less : Input tax credit (ITC) = ₹ 24 Net GST paid to Government = ₹ 12 |

(iii) Retailer:

| Tax invoice of Retailer (B2C) | GST paid to Government by Retailer |

| Selling Price of watch = ₹ 400

CGST 6% = ₹ 24 SGST 6% = ₹ 24 Total = 448 |

Total GST calculated = ₹ 48

Less : Input tax credit (ITC) = ₹ 36 Net GST paid to Government = ₹ 12 |

In above transactions we can observe that at every stage, a trader has paid GST to government after subtracting the tax he paid at the time of purchase from the tax he collected at the time of sale.

Bifurcation of taxes paid to the government by the traders at each stage :

| CGST |

SGST |

Total GST paid | |

| GST paid by Manufacturer | ₹ 12 | ₹ 12 | ₹ 24 |

| GST paid by Wholesaler | ₹ 6 | ₹ 6 | ₹ 12 |

| GST paid by Retailer | ₹ 6 | ₹ 6 | ₹ 12 |

| Total | ₹ 24 | ₹ 24 | ₹ 48 |

Remember :

- Trading between GSTIN holders is known as Business to Business, in short

- Trading between GSTIN holder and consumer is known as Business to Consumer, in short B2C. This is the last link in the trading chain.

- GST is levied and collected at every stage of trading from manufacturer to consumer.

GST - Computation and ITC

Input Tax Credit (ITC) :

- When a trader pays GST at the time of purchase, it is called ‘Input tax’. This tax is known as ITC.

- When the trader collects GST at the time of sale, it is called ‘Output tax’.

GST payable by the trader = Output tax — ITC

- While paying taxes to the government, each trader in the trading chain subtracts the tax (input tax) paid at the time of purchase from the tax (output tax) collected at the time of sale and pays the remaining tax.

| Note : A trader (tax payer) has to pay the GST within the prescribed time limit. He has to submit and file the GST returns as per the rules. All these can be done online. |

Example :

Activity : Suppose a manufacturer sold a cycle for a taxable value of ₹ 4000 to the wholesaler. Wholesaler sold it to the retailer for ₹ 4800 (taxable value). Retailer sold it to a customer for ₹ 5200 (taxable value). Rate of GST is 12%. Complete the following activity to find the payable CGST and SGST at each stage of trading.

Trading chain :

Manufacturer \(\frac{4000}{12%}\)> Wholesaler \(\frac{4800}{12%}\)> Retailer \(\frac{5200}{12%}\)> Consumer

Output tax of manufacturer = 12% of 4000 = 4000 × \(\frac{12}{100%}\) = ₹ 480

GST payable by manufacturer = ₹ 480

Output tax of wholesaler = 12% of 4800 = 4800 × \(\frac{12}{100%}\) = ₹ 576

∴ GST payable by wholesaler = Output tax - Input tax

= ₹ 576 - ₹ 480

= ₹ 96

Output tax of retailer = 12% of 5200 = 5200 × \(\frac{12}{100%}\) = ₹ 624

∴ GST payable by Retailer = Output tax of retailer - ITC of retailer

= ₹ 624 - ₹ 576

= ₹ 48

Statement of GST payable at each stage of trading :

| Individual | GST payable | CGST payable | SGST payable |

| Manufacturer | ₹ 480 | ₹ 240 | ₹ 240 |

| Wholesaler | ₹ 96 | ₹ 48 | ₹ 48 |

| Retailer | ₹ 48 | ₹ 24 | ₹ 24 |

| Total | ₹ 624 | ₹ 312 | ₹ 312 |

Remember :

(i) If the output tax of a trader is equal to the input tax :

He has paid the input tax.

Output tax is the same as input tax

∴ the tax payable by the trader = output tax — input tax = 0

∴ The trader’s payable GST is nil

(ii) If output tax of a trader is less than the input tax :

When the output tax is less than the input tax, the trader will keep the output tax with him and the difference which is less will be carried forward for the next month.

| Know This :

Composition Scheme The person whose annual turn over in the previous financial year is less than 1.5 crore can opt for composition scheme under GST rules. GST rates applicable to composition dealers are as follows. GST rates for composition Scheme

Some rules for composition dealers • Composition dealers cannot collect tax from the customers, hence they can not issue tax invoice. They have to give ‘bill of supply’. • Composition dealers should file the return quarterly (i.e. every 3 months.) • Composition dealers cannot sell goods outside the state (Inter-state sale is not allowed) But they can purchase goods from other states. • Composition dealers cannot avail the benefits of ITC. • On the signboard of the shop, he should mention ‘Composition taxable person’. • On the Bill of supply it is mandatory to print ‘Composition taxable person not eligible to collect tax on supplies’ in bold letters. |

Types of taxes under GST :

- CGST—SGST (UTGST) : Tax levied for trading within state (Intra state).

- Composition Scheme: For those GSTIN holders whose annual turnover is between 20 lakh to 1.5 crore. They pay CGST and SGST with special rates.

- IGST : Tax levied by central government for Inter-state trading. (When the trading of goods and services takes place between two (or more than two) states, the GST is levied only by the Central Government, and is termed as IGST.)

Shares :

To establish a company, desiring persons come together and form a company. Persons who form a company are called Promoters and the company is called Limited Company.

- Share : A share is the smallest unit of the capital. The value of a share is printed on company's certificate with other details is called a share certificate.

- Shareholder : A person who ovsms the share is called a shareholder. The shareholder is a part owner of the company in proportion of the number of shares he / she holdS.

- Stock exchange : The place where buying and selling of shares take place is called the stock exchange. It is also known as share market or stock market, equity market or capital market. Companies should be listed in the stock market for trading.

- Face Value (FV) : The value printed on the share certificate is called the face value of the share. It is also called Nominal value or Printed value or Par value.

- Market Value (MV) : The price at which the shares are sold or purchased in the stock market is called the market value of the share. (In live share market, the market value changes frequently.)

- Dividend : The part of annual profit of a company which is distributed per share among shareholders is called the dividend. For the shareholder the dividend income is tax free.

Comparison of FV and MV :

- If MV > FV, then the share is at premium.

- If MV = FV, then the share is at par.

- If MV < FV, then the share is at a discount

Rate of Return :

Rate of Return on investment is considered in percentage.

Rate of Return = \(\frac{Dividend\,income}{sum\,invested}\) × 100

Example :

(i) Smita has invested ₹ 12,000 and purchased shares of FV ₹ 10 at a premium of ₹ 2. Find the number of shares she purchased. complete the given activity to get the answer.

Solution : FV = ₹ 10, Premium = ₹ 2,.

∴ MV = FV + Premium = ₹ 10 + ₹ 2 = ₹ 12

∴ Number of shares = × \(frac{Total\,investment}{MV}=\frac{12000}{12}\) = 1000

Ans : Smita has purchased 1000 shares.

Brokerage and Taxes on Share Trading :

Brokerage : We buy or sell the shares through the registered members or organization (agency) of the stock market. These members are called Share Brokers. Share brokers charge some amount for undertaking the service of buying and selling of shares. The amount they charge is called Brokerage. Brokerage is paid on the market value of the share.

At the time of buying shares :

Buying price of 1 share = MV + Brokerage

At the time of selling shares :

Selling price per share = MV - Brokerage

[ Note : In the contract note of sale — purchase of shares, price of one share is shown with brokerage and taxes.]

GST on Brokerage Services :

- Share brokers provide services for purchase and sale of shares for their clients.

- These services are charged under GST.

- The rate of GST is 18 % on brokerage.

Note : For the safety of investors, there are other nominal charges besides GST on brokerage. These are Security Transaction Tax (STT ). SEBI charge, stamp duty, etc. We will consider only GST on brokerage.

Example :

(i) Nalinitai invested ₹ 6024 in the shares of FV ₹ 10 when the Market Value was ₹ 60. She sold all the shares at MV of ₹ 50 after taking 60% dividend. She paid 0.4% brokerage at each stage of transactions. What was the total gain or loss in this transaction ?

Solution : Rate of GST is not given in the example, so it is not considered.

Shares Purchased : FV = ₹ 10, MV = ₹ 60

Brokerage per share = \frac{0.4}{100}\) × 60 = ₹ 0.24

∴ Cost of one share = 60 + 0.24 = ₹ 60.24

∴ Number of shares = 6024/60.24 = 100

Shares sold : FV ₹ 10, MV = ₹ 50

∴ Brokerage per share = \frac{0.4}{100}\) × 50 = ₹ 0.20

∴ Selling price per share = ₹ (50 − 0.20) = ₹ 49.80

∴ Selling price of 100 shares = 100 × 49.80 = ₹ 4980

Dividend received 60%

∴ Dividend per share = \frac{60}{100}\) × 10 = ₹ 6

∴ Dividend on 100shares = 6 × 100 = ₹ 600

∴ Nalinitai's income = ₹ (4980 + 600) = ₹ 5580

Sum invested = ₹ 6024

∴ Loss = ₹ (6024 - 5580) = ₹ 444

Ans. Nalinitai's loss is ₹ 444

Mutual Fund – MF :

- With similar goals, a lot of investors trust the professionals with their money. The qualified specialists invest in shares as well as a number of other schemes. As a result, the risk element is reduced through investment diversification, and the whole dividend or profit is distributed equally among the investors.

- Mutual Fund is a professionally managed investment scheme, usually run by an AMC (Asset Management Company). They invest the money given by investors in different schemes, e.g. equity fund (in shares), debt fund (in debentures, bonds, etc.) or balanced fund as per the investor’s choice.

- When we invest in mutual fund, we get units. The market value of a unit is called NAV (Net asset Value).

NAV of one unit × Number of units = Total fund value.

[Note : NAV of a unit changes frequently. One can redeem the units, as per NAV, when needed.]

Systematic Investment Plan

- One could invest small amounts at regular intervals in Mutual Funds.

- This way of investment is called SIP.

- This develops discipline of savings.

- Investment in mutual fund through SIP for a long term is beneficial.

Benefits of Mutual Funds

- Professional fund managers .

- Diversifications of funds.

- Transparency and sufficiently safe investment.

- Liquidity - redemption of units can be done.

- Limited risks.

- Advantage of long term and short term gain.

- Investments in funds like ELSS are admissible for deduction under section 80C of income tax.

Click on below links to get PDF from store

PDF : Class 10th-Mathematics-Chapter-4-Financial Planning-Text Book

PDF : Class 10th-Mathematics-Chapter-4-Financial Planning-Notes

PDF : Class 10th-Mathematics-Chapter-4-Financial Planning-Solution

All Chapters Notes-Class-10-Mathematics-1 and 2- (13 PDF set) Rs. 77 -Buy

Main Page : – Maharashtra Board Class 10th-Mathematics – All chapters notes, solutions, videos, test, pdf.

Previous Chapter : Chapter-3-Arithmetic Progression – Online Notes

Next Chapter : Chapter-5-Financial Planning – Online Notes

We reply to valid query.